It’s safe to say that since the start of the pandemic, the outlook for brick and mortar has been gloomy at best.

With more consumers than ever shopping online, this has been matched by a corresponding drop in in-store sales. While ecommerce made up over a fifth of retail sales in 2020, physical retail dropped by 14%.

Business Insider forecasts that there could be as many as 10,000 store closures in 2021 – with over 1000 already on the books so far.

So, could this be the moment where brick and mortar retail finally ‘dies’?

Not quite. Retailers are already gearing up for a new wave of store openings – and many are going by the mantra ‘go big or go home’.

Yes, you that right. A study by Glossy and Modern Retail found that 34% of the brands surveyed had plans to increase their investment in physical retail this year.

You’re not alone in thinking that this strategy goes against the grain. If nothing else, the pandemic has made consumers learn first-hand that they don’t ‘need’ store locations to fulfill their desires.

And with everyone having grown accustomed to turning to the web to make purchases, aren’t these habits set to stick even once things do return to normal?

It’s certainly true that you can’t put the genie back in the bottle. So, why are retailers making such costly investments at such an uncertain time?

1. Brick and mortar is still a favored (and lucrative) channel

te all the upheaval that physical retail has experienced in the past year, it remains one of the most important selling channels. According to research by Shopify, 82.5% of all retail sales will continue to happen inside physical stores in 2021.

Not only that; offline transactions are also much more lucrative. First Insight found 71% of in-store customers spend more than $50 per transaction compared with just 54% online.

The reason is simple: Online stores with giant product catalogs can be confusing and overwhelming for consumers. Most of us make use of a range of filters so we can narrow down the available options, meaning that we remove opportunities for organic product discovery.

There’s also the simple fact that shopping in-store offers advantages where ecommerce does not. Online, we can’t try out a product, or easily get information than brand representatives. For these reasons alone, consumers will continue to favor physical retail for certain purchases – and expect stores to be there when they need them.

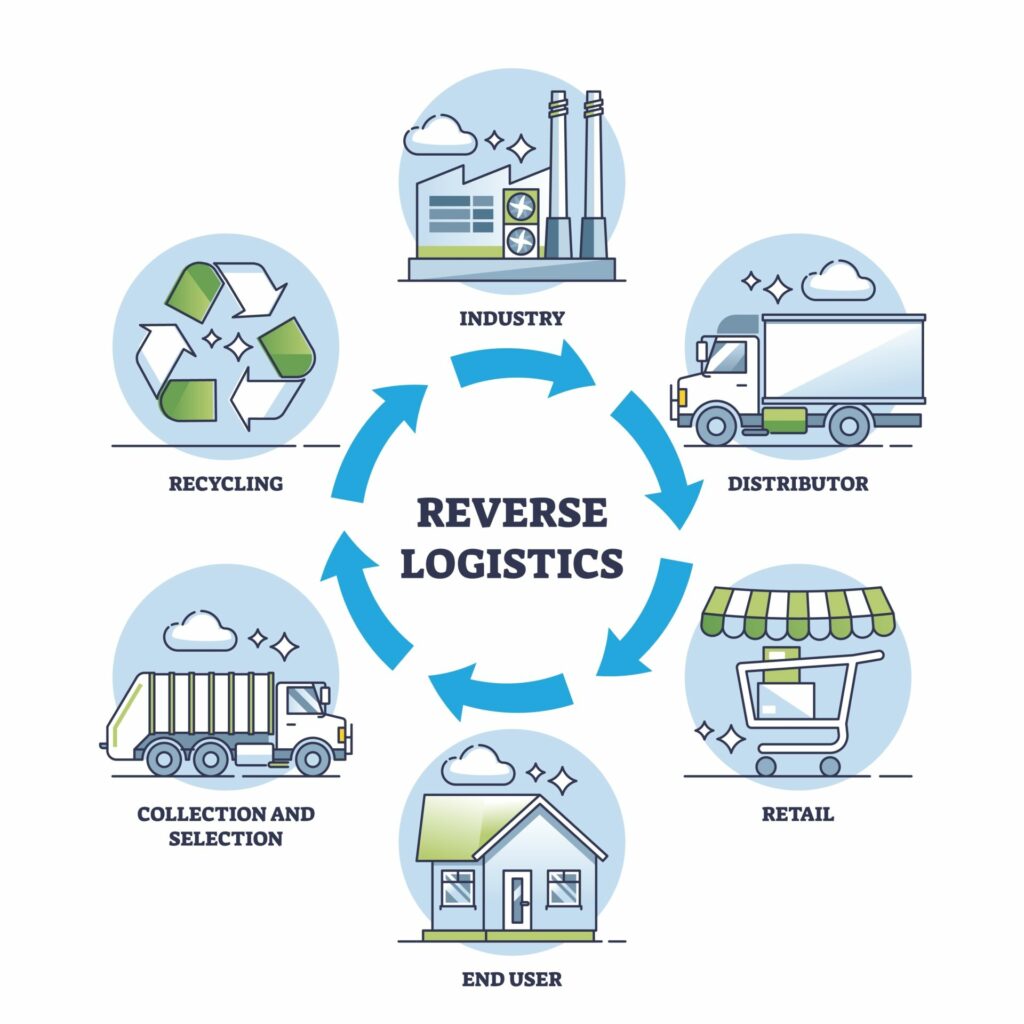

2. Micro-fulfillment is here to stay

Due to the pandemic, physical stores have inherited an entirely new value proposition. Brick and mortar locations are no longer just for browsing and buying; they’ve also become warehouses, fulfillment centers, and pick-up locations – all rolled into one.

It’s for this reason that Target is choosing to spend big on remodeling so that store locations can more effectively fulfill orders for both pick-up and home delivery. According to its latest plan, Target is investing $4 billion annually into existing stores to equip them with automated restocking and optimized fulfillment capabilities, with 30-40 new stores opening each year in metro areas to meet increased demand for same-day delivery.

The message is clear: micro-fulfillment strategies were a tidy short-term fix when stores were shuttered, and online order volumes surged. But going forward, retailers are seeing store-based fulfillment as the solution to an increasingly fluid retail landscape – and this has made brick and mortar an extremely valuable asset.

3. Consumers want immersive, hybridized retail experiences

This is where the picture gets a bit cloudier for brick and mortar. If retailers want their stores to remain relevant, they need to invest in physical retail as an important touchpoint in the customer journey – but not necessarily as the ‘end point’.

Because while consumers show a huge desire to shop in person, they don’t want to be siloed from other channels either. Ecommerce, social media, and mobile apps add huge value to the in-store experience through research and community-building – and stores need to embrace this interconnectivity if they want to offer cohesive shopping experiences.

Fabletics is one such brand that has stepped up to the plate by announcing 24 new store locations for 2021. But these aren’t just any old stores; they’ll boast interactive experiences including in-store fitness studios, touch screens for their ‘leggings finder’ quiz, and handheld POS systems that allow store associates to seamlessly access customer’s online profiles. This follows moves by major retailers including Old Spice, Lululemon, Nike, and Sephora to reposition their own offline store experiences to better connect with customers.

The growth of experiential retail is a clear sign that brands are looking and listening to what consumers want; more immersive, personalized shopping experiences that allow them to move between channels with ease.

What does the pandemic mean for the future of brick and mortar?

So, rather than sounding (another) death-knell to physical retail, the pandemic has proven that offline selling continues to provide benefits to both consumers and brands.

But at the same time, it’s also shown that the value of brick and mortar is no longer self-evident.

In 2021, it’s not enough for stores to just act as showrooms for products that can be bought online; customers need to be given a reason to come in.

It’s a lesson that’s been learned the hard way by legacy retailers. The likes of J.C. Penney and Macey’s have been closing stores en-masse not despite their pivot towards ecommerce, but because of it.

When native brick and mortar retailers began launching their digital storefronts, it resulted in an unintended phenomenon; customers who normally bought in-store choosing to maximize convenience by shopping online.

The result? A loss of valuable foot traffic – and the cannibalization of their own sales.

Because when buying online is easier, faster, and involves less friction, consumers are left with little incentive to shop in person.

If we look at the major retailers who’ve avoided this fate, they all have one thing in common; their store experiences bring more to the table than digital-only can provide.

Whether the value proposition is cool retail partnerships, exclusive in-store products, or cutting-edge AR experiences, it’s underpinned by one key conviction: Both ecommerce and brick and mortar can thrive when they see each other as allies, rather than competitors. The massive popularity of curbside pick-up during the pandemic is a prime example of the innovations that retailers can introduce when they have synergy between their channels.

In essence, when offline and online selling reinforces each other’s strengths, brands don’t just remove friction from the customer experience; they create more opportunities to boost revenue.

Next week, we’re going to take a look at the phenomenon of pop-up retailing – and why it’s the first port of entry of digitally native brands seeking to capture some of that in-store magic.

Stay tuned!